Authors: Arvind Agarwal, Founder & CEO, and Ajay Raja, Senior Analyst – C4D Partners

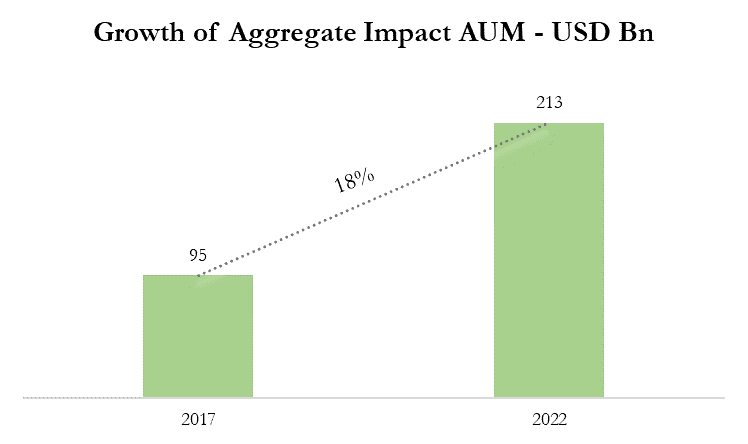

In the aftermath of the pandemic, impact investing has witnessed vigorous growth across geographies, stages, and sectors. According to a survey released by the Global Impact Investing Network (GIIN), among the 88 global fund managers and repeated respondents of the study, the aggregate impact assets under management (AUM) surged from USD 95 billion in 2017 to USD 213 billion in 2022, reflecting a CAGR of ~18%.

While the surging figures seem glorious, a question arises as to what qualifies as an Impact AUM because which fund, LP, or organization can be considered to be an impact fund, investor, or company has not been concretely defined and established in the global investment market.

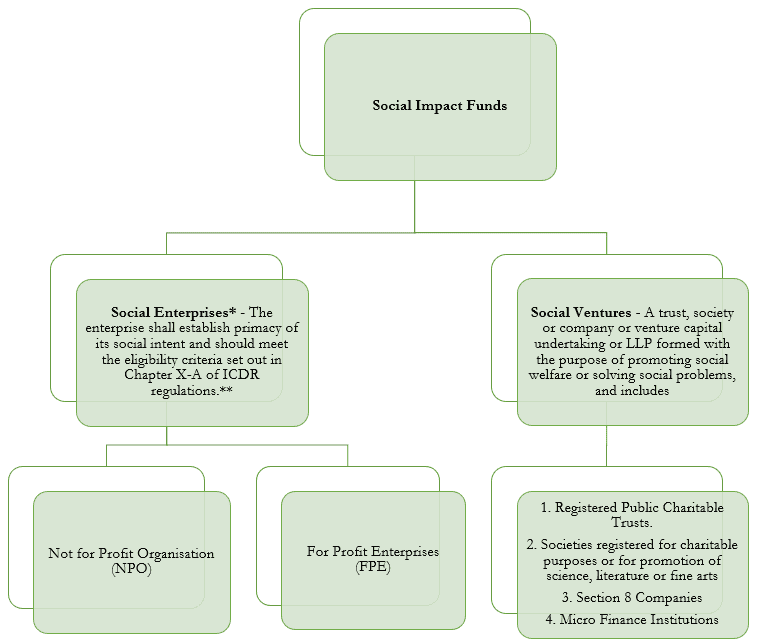

Countering this ambiguity, Social Impact Funds (SIF), a separate sub-category of Category-I Alternative Investment Fund (AIF) was introduced in India in July 2022. SIFs have replaced the erstwhile Social Venture Funds (SVF), which had challenges in becoming an operational category. This new AIF sub-category primarily invests at least 75% in unlisted securities of social ventures and social enterprises and may also issue social units (units that provide only social returns). This means that SIFs can invest in non-profit organizations as well as for-profit enterprises.

* Corporate Foundations, Political or religious organizations or activities, professional or trade associations, infrastructure, and housing companies, except affordable housing, shall not be eligible to be identified as a social enterprise.

** The Social enterprise is defined in the SEBI (Issue of Capital and Disclosure Requirements) (Third Amendment) Regulations, 2022, released on 25th July 2022. You can access the amendment here.

Recognizing the global momentum in impact investing, SEBI’s move to introduce a distinct AIF vehicle for impact funds is a significant step in the positive direction of the impact investing ecosystem. While SEBI had previously made a similar attempt with SVF, here are the changes presented with SIFs –

We acknowledge that the reduction of investment cheque sizes is aligned with the greater good of the ecosystem, and the omission of the restricted returns clause aids in building investor confidence. However, there are a few questions that we believe need to be discussed –

In light of these questions, here are our suggestions that we believe would help enhance the impact investing space and ensure optimal benefits for all its stakeholders.

Separate fund vehicle for FPEs and NPOs: Placing FPE and NPO investing SIFs under one umbrella could compromise their objectives. Impact investments must generate social outcomes along with financial returns, which won’t be possible for NPOs. Moreover, the reporting cost could negate the benefits of an SIF investing only in NPOs. Establishing distinct investment vehicles for FPEs and NPOs would offer social impact firms greater clarity and traction for sustainable growth.

Fund Life: Impact capital is patient capital. Sufficient time is required to create meaningful impact at the grassroots level. Therefore, we believe that the standard fund life of 10 years might not be suitable for impact investing SIFs and propose a fund term of at least 12 years.

Management Fee: While advocating for a longer fund term, it’s essential to ensure that investors are not unduly burdened with higher management fees for the extended term. To address this, we advise an arrangement between the fund managers and their investors for the management fees to be capped at the market rate.

Social Cause-Linked Returns: As compensation for their performance, in addition to their management fees, fund managers earn additional returns as well. We highly recommend that the percentage of these returns be tied to the impact objectives accomplished, incentivizing fund managers to balance intended impact and financial return.

Prohibit misuse of “Impact”: There are market players who obtain registration under other sub-categories and yet claim to be impact funds, probably due to ambiguity among the funds regarding the commercial and legal structures at this point. However, we believe that in maintaining integrity within the impact investing sphere and allowing capital intended for impact to be rightly directed toward impact funds, entities registered as other AIF sub-categories must be prohibited from misrepresenting themselves as impact funds once SIF is operational/functional.

The appetite for sustainable growth and development is picking pace across the globe. With the introduction of Social Impact Funds and Social Stock Exchange, SEBI underscores India’s commitment to Impact investing. This will broaden opportunities for numerous social entrepreneurs across the country to secure funding. With standardized reporting and regulatory measures in place, we can unlock the full potential of Impact investing to drive meaningful change in society.